Redesigning a Fintech Platform for Enhanced Usability and Data Discoverability

Client

Fiserv

Services

Industries

Category

Financial Technology |

Web Application |

UX/UI Design

Engagement

Application Redesign and Development

Technologies

Brief

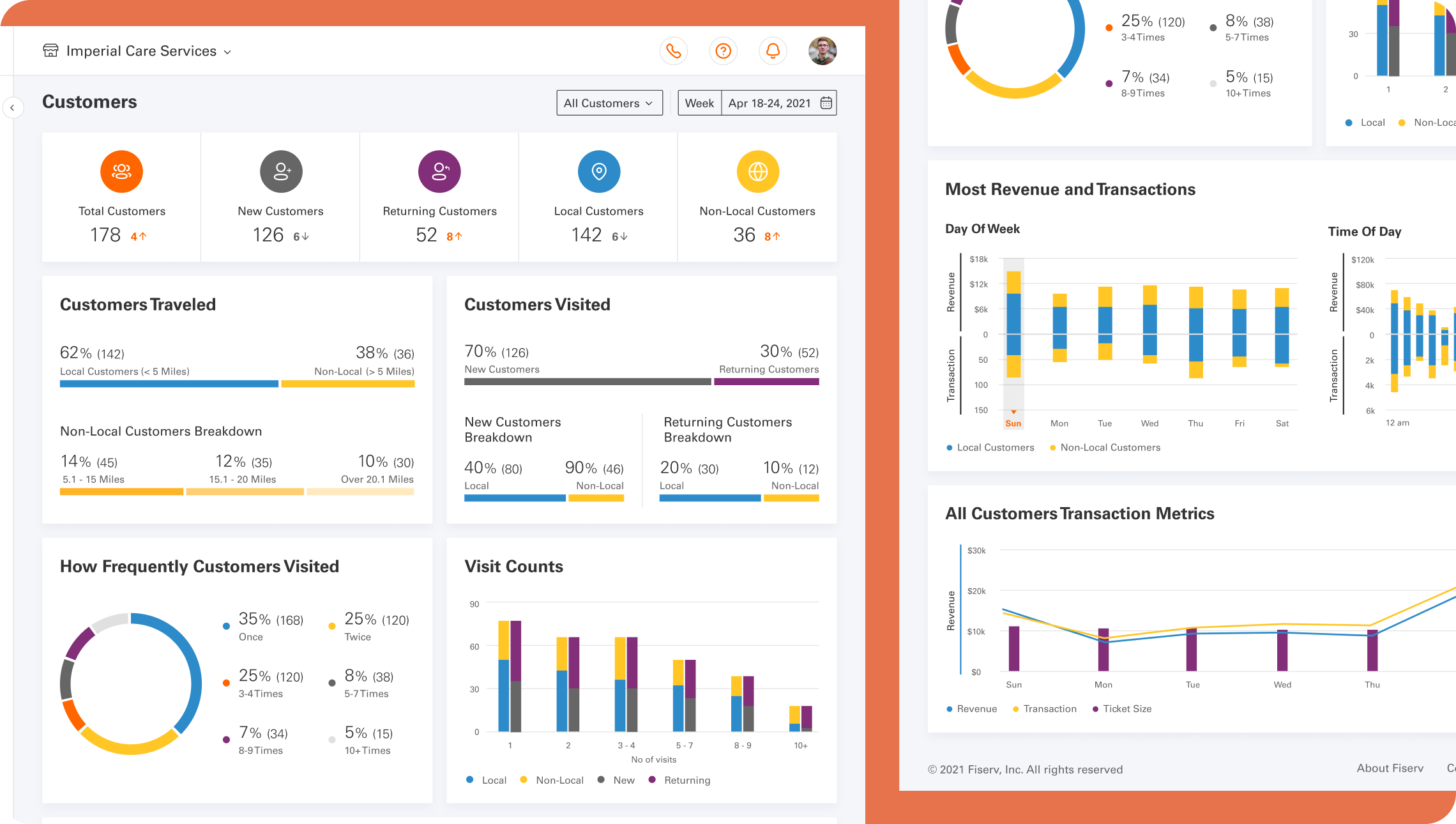

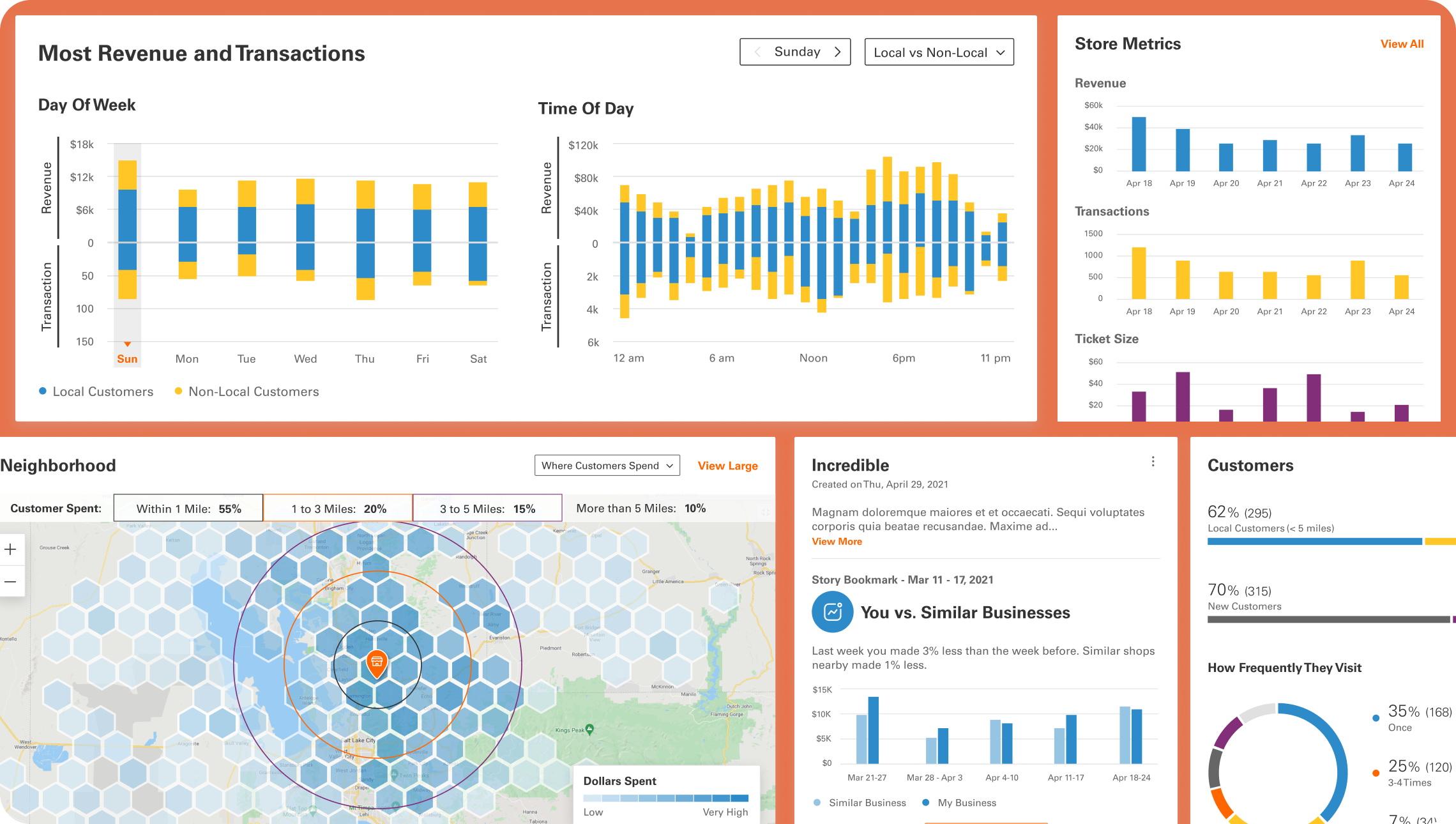

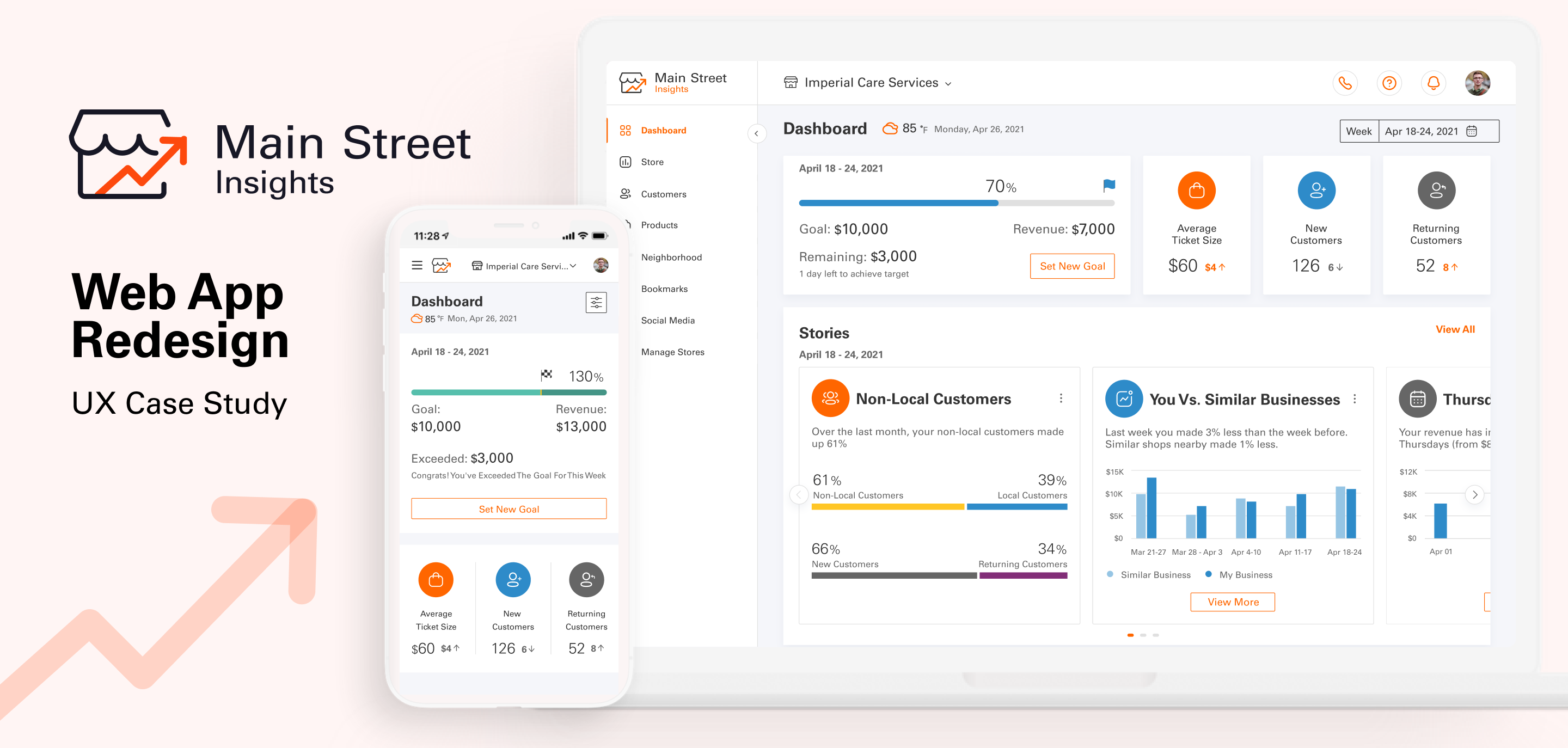

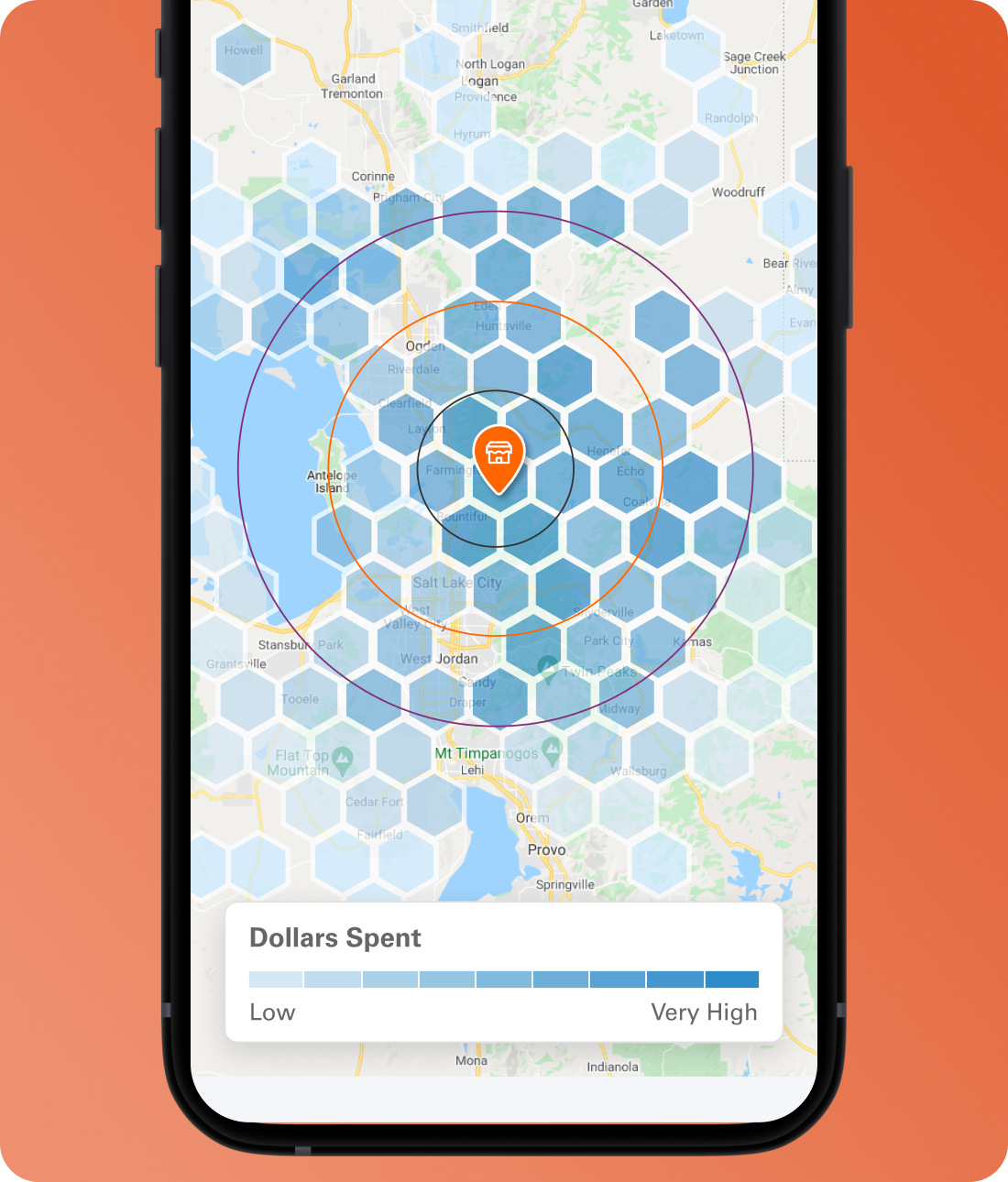

Fiserv, a global leader in financial technology, recognized the need to enhance its Main Street Insights (MSI) application to better serve its clients in the ever-evolving financial landscape. MSI is a powerful platform that provides businesses with valuable insights into customer behavior and spending patterns by analyzing credit card usage data. However, the existing application’s user interface and data visualization capabilities needed modernization to improve usability, data discoverability, and overall user experience. Fiserv partnered with Galaxy Weblinks to revitalize the MSI application, focusing on creating a more intuitive and engaging platform that empowers businesses to extract actionable insights from their data and make informed decisions.

The Challenge

The existing MSI application presented several key challenges that needed to be addressed to enhance its effectiveness and user satisfaction:

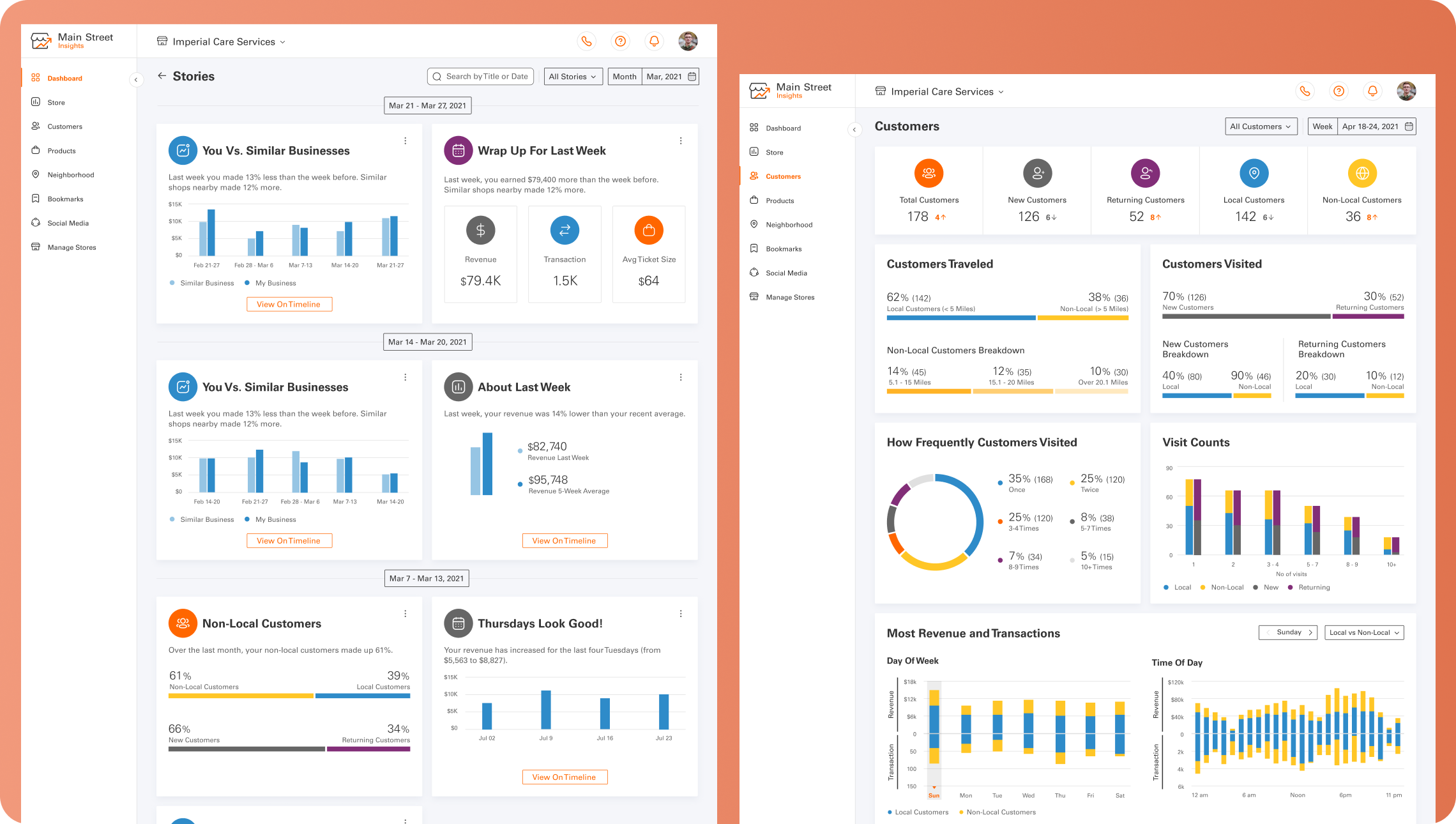

- Complex Data Visualization: The application needed to present complex financial data, such as sales trends, customer demographics, and spending patterns, in a clear, concise, and easily understandable format. This involved transforming raw data into meaningful visualizations that facilitate quick comprehension and analysis.

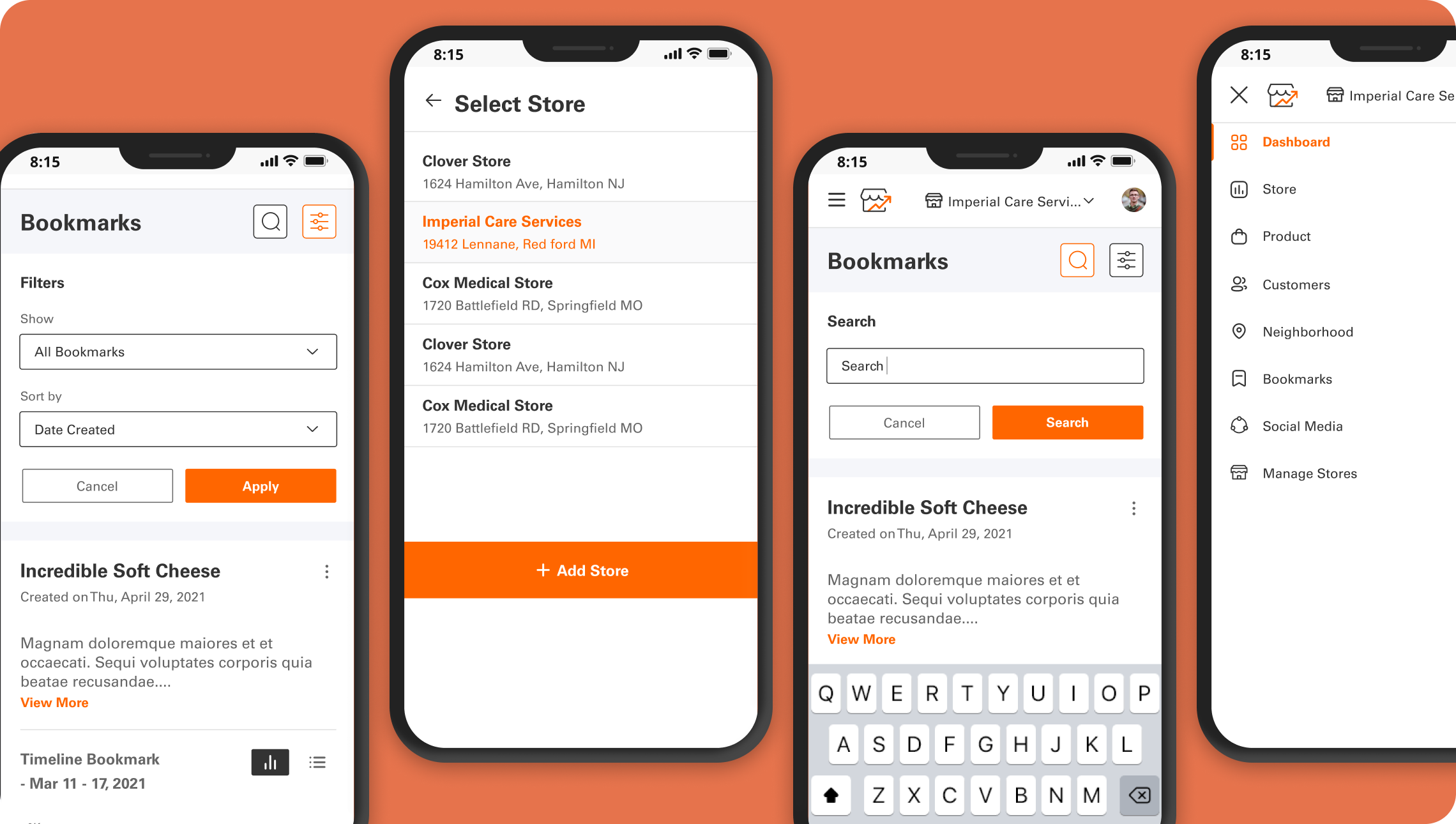

- Usability Issues: The existing user interface presented challenges in terms of navigation, information hierarchy, and overall user flow. This hindered users’ ability to efficiently access and interact with the application’s features and data.

- Limited Data Discoverability: Users faced difficulties in quickly and easily finding the specific data they needed within the application. The search functionality and data filtering options needed improvement to enable efficient data exploration and analysis.

- Outdated Design: The application’s visual design felt outdated and did not align with current design trends or Fiserv’s brand identity. A modern and visually appealing interface was needed to enhance user engagement and reflect Fiserv’s position as a leader in financial technology.

Proposed Solution

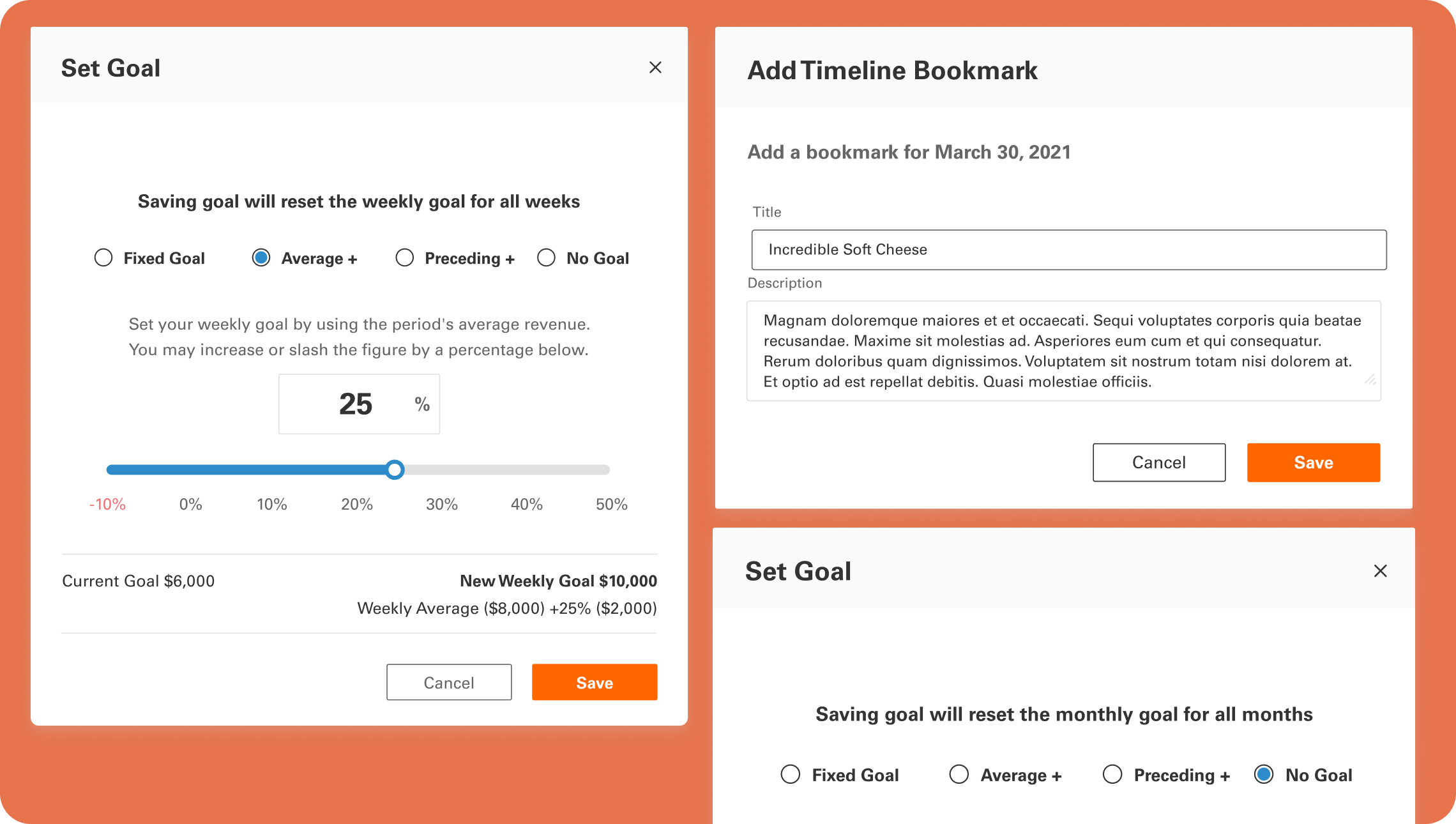

A comprehensive application redesign and development project was undertaken to enhance the usability and data discoverability of the MSI application. This involved:

- Conducting UX research to understand user needs and pain points with the existing application, including user interviews, surveys, and usability testing.

- Redesigning the user interface (UI) to improve clarity, navigation, and visual appeal, incorporating modern design principles and best practices.

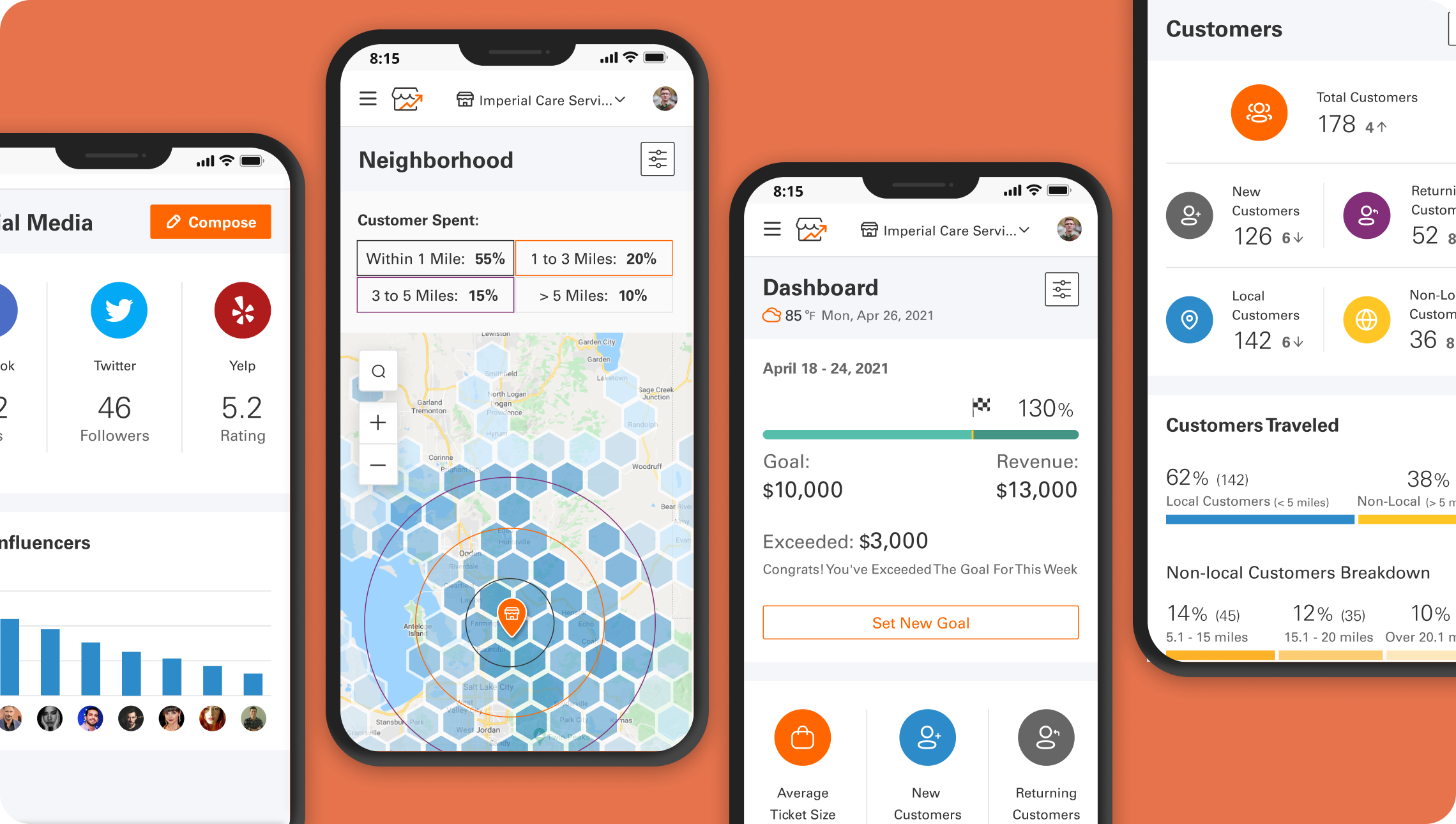

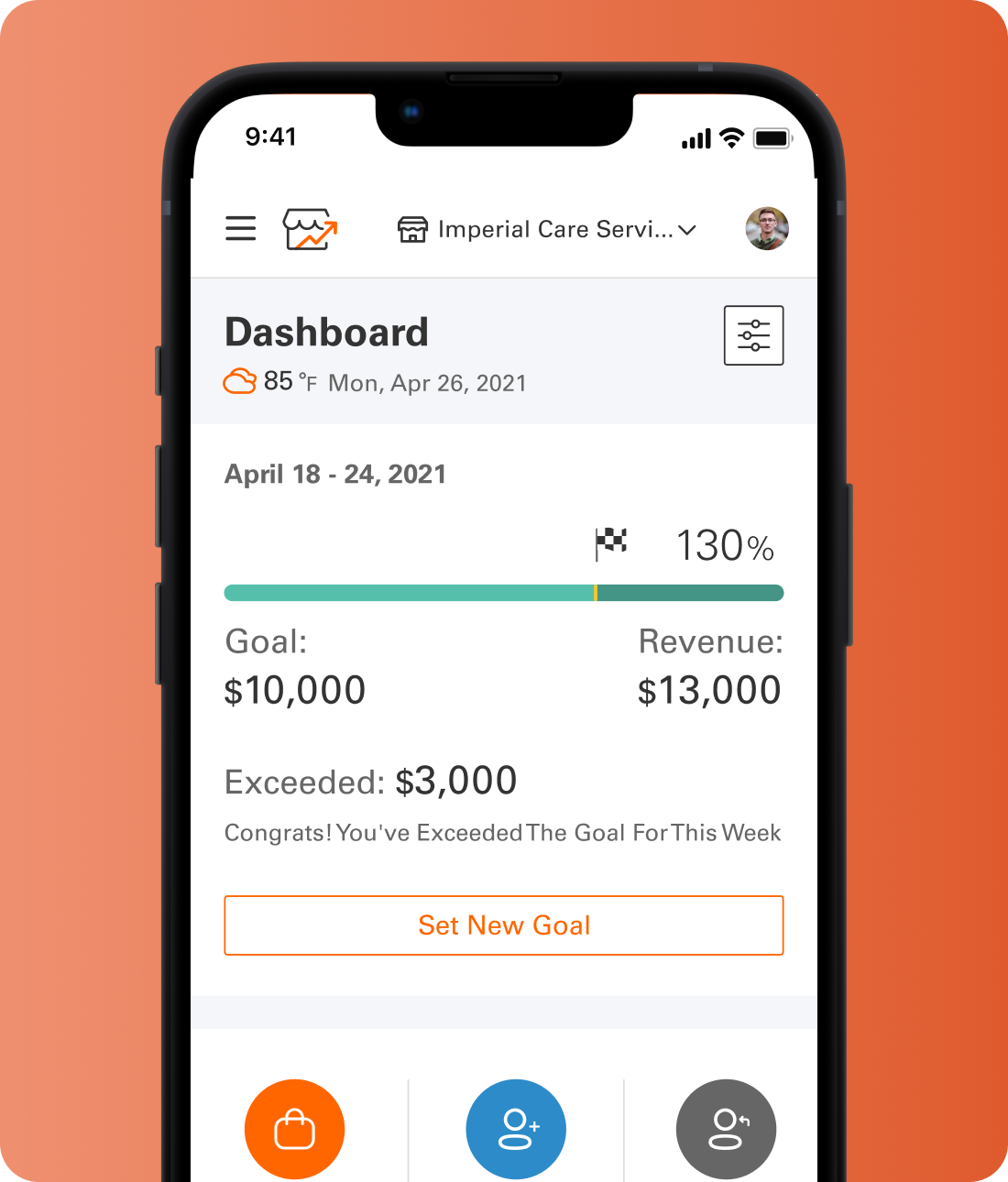

- Developing interactive data visualizations to present key insights in a more engaging and understandable format, using charts, graphs, and maps to represent complex data sets.

- Optimizing the application’s performance and ensuring compatibility across various devices and browsers, including desktops, laptops, tablets, and smartphones.

Key Deliverables

Key Feature Enhancements

Delivery and Deployment

The redesigned MSI application was launched, providing Fiserv's clients with an enhanced user experience and improved data discoverability.

The application was rigorously tested across various devices and browsers to ensure optimal performance, security, and usability.

Ongoing maintenance and support are provided to ensure the application remains up-to-date, secure, and aligned with evolving user needs and technological advancements.

Value Creation and Impact of the Solution

Commercial Impact

The redesigned MSI application is projected to increase user engagement and satisfaction, leading to a 15% rise in application usage and data analysis activities within the first year.

The improved data visualization and discoverability are expected to empower Fiserv’s clients to make more informed business decisions, potentially leading to a 10% increase in revenue or efficiency gains.

The enhanced user experience and modernized interface are anticipated to strengthen Fiserv’s brand reputation as a provider of innovative and user-friendly financial technology solutions.

Impact on Brand Equity

The redesigned MSI application reinforces Fiserv’s brand identity as a leader in financial technology, showcasing its commitment to providing cutting-edge solutions that meet the evolving needs of its clients.

The user-centric approach and focus on usability enhance brand perception and build trust among Fiserv’s clients and partners.

Platform for Future Innovation

The application’s flexible architecture and modular design allow for easy integration of new features and functionalities as Fiserv’s business needs and technological advancements evolve, ensuring the platform remains adaptable and future-proof.

The platform’s scalability supports future growth and expansion, accommodating increasing data volumes and user activity without compromising performance.

By leveraging user feedback and data-driven insights, Fiserv can continuously optimize the MSI application and personalize the user experience, ensuring it remains engaging and relevant to its clients.